Helping you achieve what matters

Financial Oversight and Guidance

Develop a proper business plan for life and achieve what matters to you.

Too many financial plans are driven by sales tactics that lead to the purchase of insurance and investment products.

A comprehensive financial plan should be based on cash flow and tax impact, and individuals should view all estate-related concerns - everything they own - as a business entity.

An effective, comprehensive plan can seem overwhelming, but with the right help and assistance, we can achieve successful planning, one step at a time.

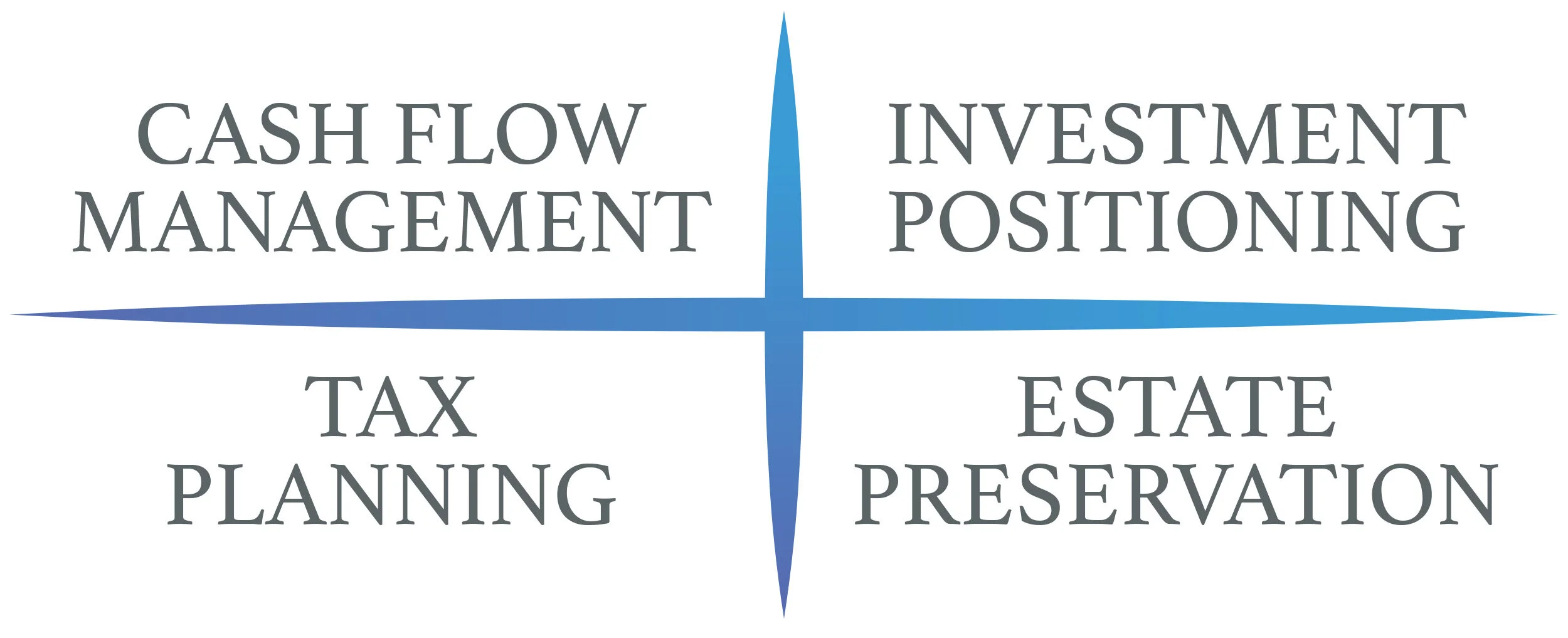

Integrate tax strategies, estate planning concepts, investment management and cash flow.

Each quadrant is a major component of comprehensive planning, and each requires competent analysis followed by the careful crafting of strategies tailored to you. Poor judgement or bad decisions in any of these areas can cost money and earnings power. You can maintain or increase your income and avoid, minimize or defer taxes through:

· Cash flow management system

· Advanced tax planning

· Sound asset management

· Estate control

Coordinate all the planning elements.

The decisions you make in one area can dramatically affect your results in another. Only by coordinating plans and conducting impact analysis of decisions will you always be able to see the big picture.

This should include preparing for life’s “consistent inconsistencies” by incorporating as many “what if” scenarios as practical and coordinating them appropriately.

How would you feel if you had a coordinated plan for all four areas?

Let’s schedule a call to get absolutely clear about what matters most to you and your next steps to getting there.

Business Tax & Retirement Planning

Learn the strategies that have helped other business owners meet both company and personal goals at every stage of their journeys.

Growing your Business

Save time and money by using tax-efficient strategies for you and your employees. Growing your business leaves little time for long-term planning, but aligning business objectives with personal goals is critical at this stage.

Transitioning your Business

Optimize the value of your business through holistic planning in advance of a partial liquidity event, generational transition or sale. Whether you keep or sell your business, a well-executed transition strategy can help your business and family flourish for generations to come. Explore advice that has helped other business owners succeed during this crucial phase.

Life after Transition

Your hard work, talent and discipline drove the success of your company. Explore opportunities to make the most of your time and your strengths as you transition to the next phase of your life. Life in retirement is not just what you see in the commercials. Sitting at the beach may be part of it but creating a new vision as you transition into retirement can make all the difference.

Let’s schedule a call to get absolutely clear about what matters most to you and your next steps to getting there.